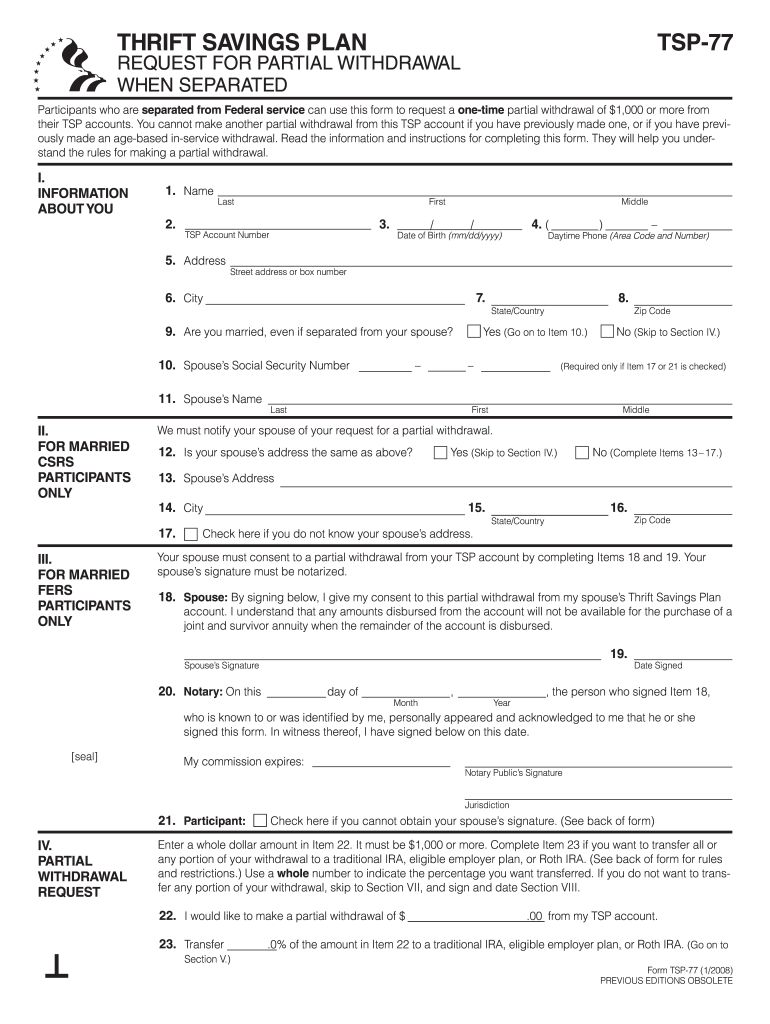

Who needs a form TSP-77?

This is a request for a one-time partial withdrawal from a Thrift Savings Plan account. Federal employees of civil and uniformed services have a right to withdraw $1000 or more when they vacate their posts. Instructions inside these forms contain a list of characteristics that eliminate applicant’s eligibility for a one-time withdrawal. They are as follows:

-

Applicant’s vested account balance is less than $1000

-

Applicant has made a partial withdrawal already. A second withdrawal is not allowed.

-

Previously, an age-based in-service withdrawal was made

-

An applicant considers re-hiring after separating from Federal service (in case a break lasted less than 31 days).

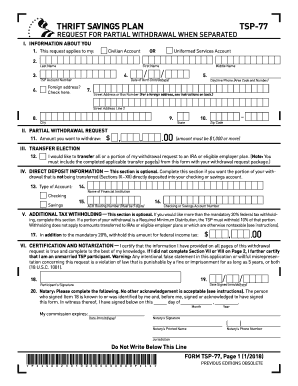

What is form TSP-77 for?

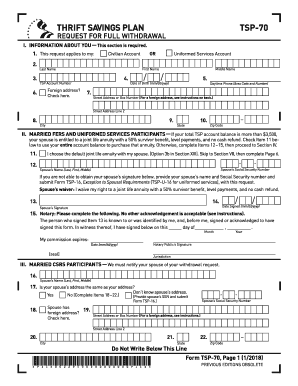

Form TSP-77 is one of the options for money withdrawal from a TSP account. This form helps applicants who are willing to keep the account. They have an opportunity to obtain a necessary sum without full withdrawal (which is a better option in some cases). To learn more about other options for money withdrawal, visit the TSP’s official website.

Is it accompanied by other forms?

It doesn’t require any attachments.

When is form TSP-77 due?

Applicants are free to request partial withdrawal whenever they want, except for the above-described circumstances. There is no due date for filing form TSP-77.

How do I fill out a form TSP-77?

There are two pages with a detailed questionnaire. Answers to these questions must be complete, honest, and up-to-date. Payment transfers must be revised by the recipient financial institution.

Where do I send it?

The TSP office accepts form 77 by mail or online. Make a copy for you records and send the original to:

Thrift Savings Plan

P.O. Box 385021

Birmingham, Al 35238

Or fax it to 1-866-817-5023.